Countries With Local Coverage

- Home

- Countries With Local Coverage

Global Reach, Local Expertise: Custom Debt Collection Solutions for Every Country

At NCCOS, we understand that each country comes with its own set of laws, cultural expectations, and challenges when it comes to debt recovery. That’s why we provide tailored debt collection services that respect local regulations, ensuring an ethical, efficient, and compliant approach to recovering debts worldwide.

With more than 10 years of international experience, NCCOS offers region-specific expertise in debt collection, guaranteeing adherence to local laws while optimizing recovery success. Whether you’re dealing with consumer or commercial debt, our global network of multilingual professionals is equipped to handle your needs.

Countries We Served

Comprehensive Debt Collection Solutions Around the Globe

- Expertise in country-specific debt collection laws

- Strict adherence to global regulations

- Debt recovery strategies personalized to each debtor’s location and profile

- Multi-channel communication including calls, emails, and in-person visits

- On-the-ground agents familiar with regional debtor behavior

- Support for both urban and rural debt collections

- Debt collection available in multiple languages for clear communication

- Specialized teams for complex negotiations

- Use of cutting-edge tools to track debtors, even those who have relocated internationally

- Amicable resolutions to preserve long-term debtor relationships

- Mediation and arbitration for complex cases

- Expertise in sectors like banking, finance, education and healthcare.

- From initial debtor contact to final settlement or legal action, we oversee the entire process

With NCCOS, managing debt recovery across borders becomes effortless. Whether dealing with international B2B collections or intricate consumer debt situations, our localized approach ensures success.

Global Debt Recovery Challenges and How NCCOS Overcomes Them

- Debt recovery laws vary by country, and failure to comply can result in penalties. We navigate these complexities to avoid issues.

- Language differences and cultural nuances can complicate negotiations. Our multilingual, culturally aware team ensures smooth communication.

- Economic instability can affect recovery. We adapt strategies to address currency fluctuations and volatile financial conditions.

- Debtors often relocate or evade payment, particularly across borders. Our advanced tracing methods ensure we track them down effectively.

- Time zone differences can delay recovery efforts. Our global network allows us to work efficiently across multiple time zones.

- Aggressive tactics can harm your reputation. We emphasize ethical, respectful methods to protect your relationships with debtors.

- Missing documentation can slow recovery. Our thorough approach ensures that all necessary documentation is in place for legal proceedings.

- Debtors may dispute debts or refuse cooperation. We handle these challenges with effective conflict resolution and negotiation.

- Cross-border collections often involve high costs. We provide efficient, cost-effective services to minimize expenses.

- Recovering unsecured debts is more difficult. Our strategies are designed to maximize recovery even when no collateral is involved.

- Payment delays can disrupt business cash flow. Our swift and efficient recovery process helps restore financial stability.

What to Look for in an International Debt Collection Agency

When selecting a global debt collection agency, consider these essential factors to ensure you partner with a reliable, ethical, and effective provider:

The agency should have a strong understanding of local regulations, cultures, and economic conditions to enforce effective collection strategies.

- A track record of success indicates that the agency can handle complex, cross-border debt recovery challenges.

- Adherence to local and international laws like GDPR, FDCPA, and others is essential to avoid legal repercussions.

- The agency should use advanced tools to optimize collection efforts and stay on top of progress in real time.

- A clear fee structure helps you evaluate the agency’s value and avoid hidden costs.

- The agency should maintain ethical recovery methods that safeguard your company’s reputation.

- Tailored payment options for diverse markets can improve recovery success.

- Choose an agency with a proven ability to recover substantial portions of debt.

- The agency’s approach to resolving disputes and maintaining long-term debtor relationships is key to successful recovery.

- Whether the debt is unsecured, commercial, or consumer-based, the agency should be versatile in handling different debt types.

Our Global Debt Recovery Strategy

- We ensure all collections follow relevant local laws and international regulations and regional trade laws to protect your business.

- We create personalized strategies based on factors like debtor location, economic conditions, and industry-specific challenges to maximize success.

- Our agents are trained in language and culture to ensure effective communication and smooth negotiations.

- We use advanced AI-driven tools, real-time case tracking, and skip tracing technologies to streamline the recovery process.

- Beyond debt collection, we offer legal representation, credit reporting, and financial analysis to support long-term repayment plans.

Debt collection Slovenia

Debt collection Germany

Debt collection Albania

Debt collection Andorra

Debt collection Serbia

Debt collection Malta

Debt collection Slovakia

Debt collection Bulgaria

Debt collection Sweden

Debt collection Moldova

Debt collection Liechtenstein

Debt collection Russia

Debt collection England

Debt collection Scotland

Debt collection Finland

Debt collection France

Debt collection Austria

Debt collection Moldova

Debt collection Spain

Debt collection Iceland

Debt collection Croatia

Debt collection Denmark

Debt collection Romania

Debt collection San Marino

Debt collection UK

Debt collection Wales

Debt collection Luxembourg

Debt collection Macedonia

Debt collection Georgia

Debt collection Monaco

Debt collection Montenegro

Debt collection Netherlands

Debt collection Ireland

Debt collection Denmark

Debt collection Switzerland

Debt collection Cyprus

Debt collection Greece

Debt collection Italy

Debt collection Norway

Debt collection Czech republic

Debt collection Kosovo

Debt collection Portugal

Debt collection Ukraine

Debt collection Lithuania

Debt collection Romania

Debt collection Argentina

Debt collection Mexico

Debt collection Colombia

Debt collection Antigua and Barbuda

Debt collection in Venezuela

Debt collection Brazil

Debt collection Chile

Debt collection Peru

Debt collection Barbados

Debt collection Algeria

Debt collection Morocco

Debt collection Ghana

Debt collection Kenya

Debt collection Liberia

Debt collection Mauritius

Debt collection Nigeria

Debt collection Somalia

Debt collection Tanzania

Debt collection Zambia

Debt collection South Africa

Debt collection Tunisia

Debt collection Ivory Coast

Debt collection Libya

Debt collection Mali

Debt collection Mozambique

Debt collection Senegal

Debt collection Sudan

Debt collection Uganda

Debt collection Zimbabwe

Debt collection UAE

Debt collection Abu Dhabi

Debt collection Israel

Debt collection Iraq

Debt collection Jordan

Debt collection Lebanon

Debt collection Oman

Debt collection Syria

Debt collection Dubai

Debt collection Turkey

Debt collection Bahrain

Debt collection Iran

Debt collection Kuwait

Debt collection Saudi Arabia

Debt collection Qatar

Debt collection in Yemen

Debt collection Hong Kong

Debt collection Pakistan

Debt collection Armenia

Debt collection China

Debt collection Vietnam

Debt collection Indonesia

Debt collection Philippines

Debt collection Malaysia

Debt collection Nepal

Debt collection Singapore

Debt collection Taiwan

Debt collection Uzbekistan

Debt collection India

Debt collection Afghanistan

Debt collection Azerbaijan

Debt collection Japan

Debt collection Thailand

Debt collection North Korea

Debt collection South Korea

Debt collection Maldives

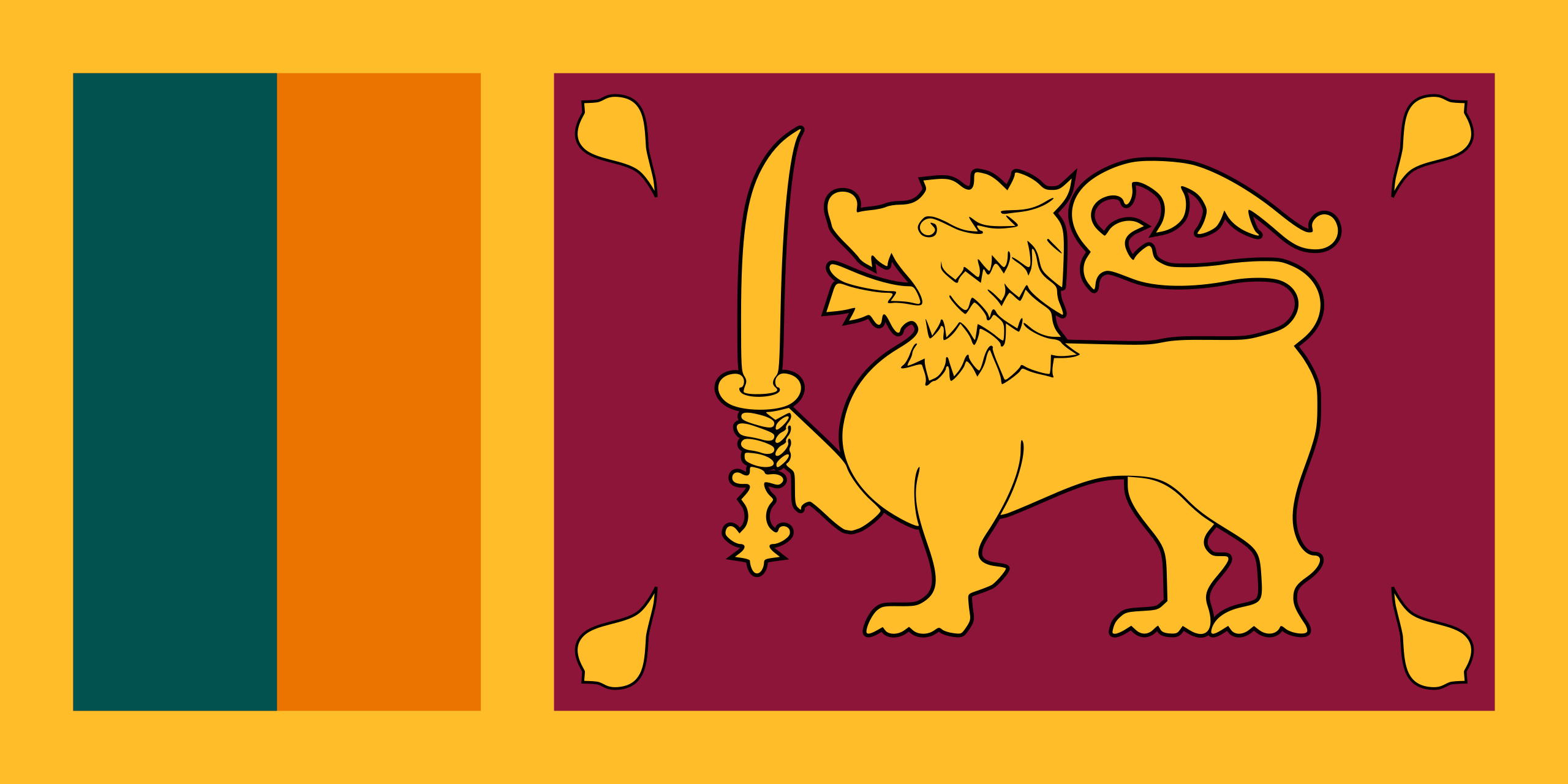

Debt collection Sri Lanka

Debt collection Turkmenistan

Debt collection Australia

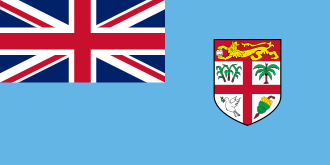

Debt collection Fiji

Debt collection Haiti

Debt collection New Zealand

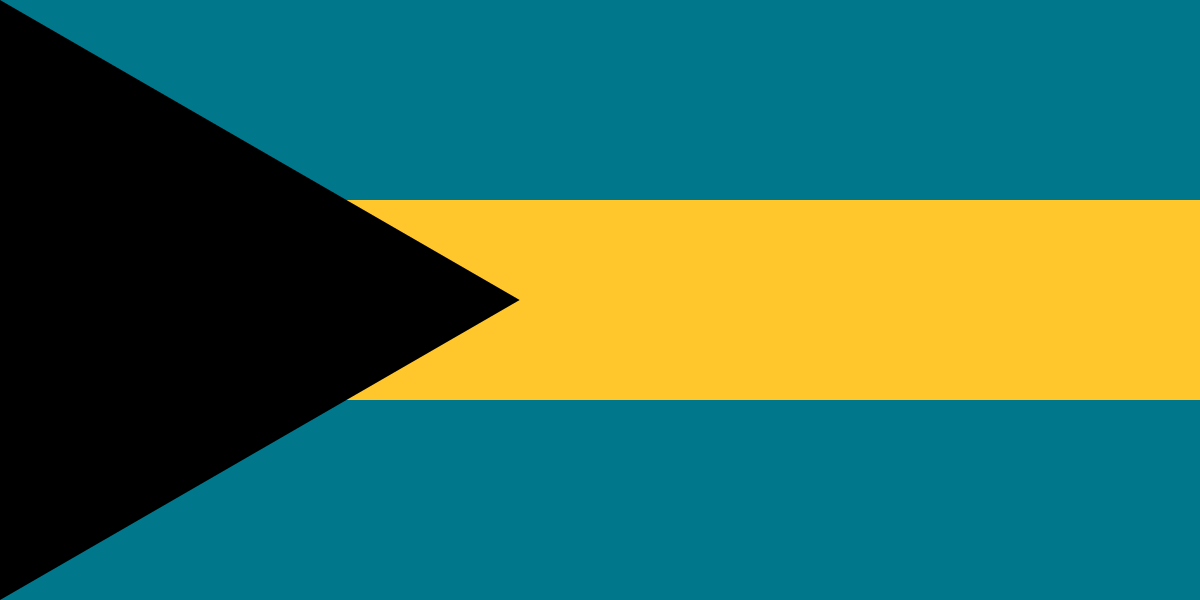

Debt collection The Bahamas

Debt collection Guatemala

Debt collection Honduras

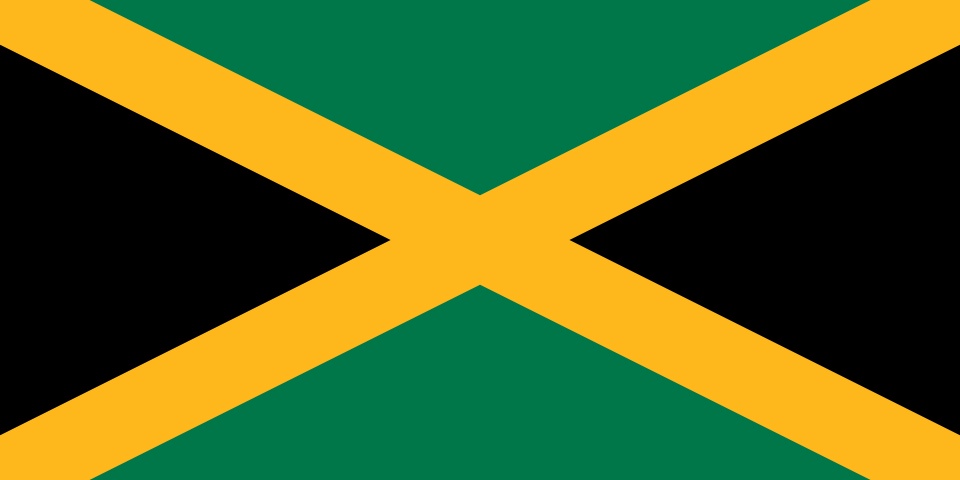

Debt collection Jamaica